Eb5 Investment Immigration - An Overview

Eb5 Investment Immigration - An Overview

Blog Article

Top Guidelines Of Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration for Beginners8 Simple Techniques For Eb5 Investment ImmigrationGetting My Eb5 Investment Immigration To WorkThe 8-Minute Rule for Eb5 Investment ImmigrationA Biased View of Eb5 Investment Immigration

Contiguity is developed if demographics systems share boundaries. To the level feasible, the combined census systems for TEAs should be within one city location without any even more than 20 demographics tracts in a TEA. The combined demographics systems should be a consistent form and the address should be centrally situated.For more details about the program see the U.S. Citizenship and Immigration Services site. Please enable 1 month to refine your demand. We generally react within 5-10 organization days of getting accreditation demands.

The united state government has actually taken actions targeted at increasing the level of international investment for nearly a century. In the Migration Act of 1924, Congress introduced the E-1 treaty investor course to assist facilitate profession by foreign merchants in the United States on a short-term basis. This program was increased via the Immigration and Race Act (INA) of 1952, which developed the E-2 treaty investor course to more bring in international investment.

employees within two years of the immigrant financier's admission to the USA (or in certain circumstances, within a sensible time after the two-year duration). In addition, USCIS may credit financiers with protecting tasks in a troubled business, which is defined as a venture that has actually been in presence for at the very least 2 years and has endured a bottom line throughout either the previous one year or 24 months before the priority date on the immigrant financier's preliminary petition.

The Eb5 Investment Immigration Statements

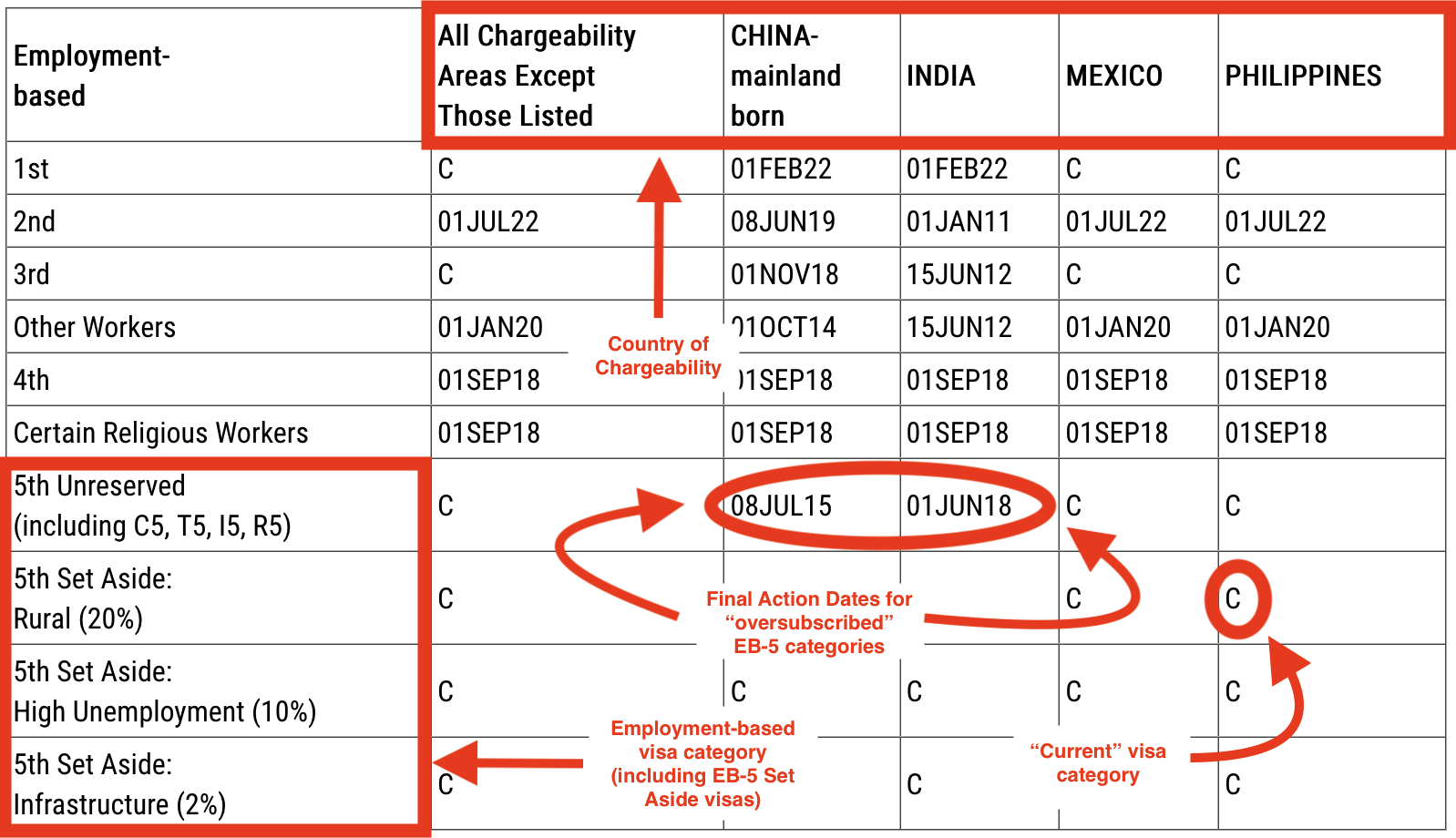

(TEA), which include specific designated high-unemployment or country areas., which qualifies their international investors for the lower financial investment threshold.

To receive an EB-5 visa, a financier should: Spend or remain in the process of investing a minimum of $1.05 million in a brand-new business in the USA or Spend or be in the process of investing at the very least $800,000 in a Targeted Work Location. EB5 Investment Immigration. (On March 15, 2022, these quantities raised; before that day, the U.S

Extra particularly, it's a location that's experiencing at the very least 150 percent of the nationwide typical price of joblessness. There are some exemptions to the $1.05 million business venture investment. One method is by establishing the financial investment business in a financially challenged location. You might contribute a lower business investment of $800,000 in a rural location with much less than 20,000 in population.

Some Known Details About Eb5 Investment Immigration

Regional Center financial investments allow for the consideration of financial influence on the regional economy in the kind of indirect work. Any kind of financier considering investing with a Regional Center have to be very careful to think about the experience and success price of the firm prior to investing.

The investor initially requires to submit an I-526 request with united state Citizenship and Immigration Services (USCIS). This application must consist of go to this web-site proof that the investment will develop full time work for at the very least 10 united state people, irreversible locals, or other immigrants who are authorized to function in the USA. After USCIS approves the I-526 petition, the capitalist may apply for an environment-friendly card.

The Greatest Guide To Eb5 Investment Immigration

If the financier is outside the United States, they will certainly need to go via consular handling. Investor copyright come with conditions attached.

Yes, in certain scenarios. The EB-5 Reform and Honesty Act of 2022 (RIA) included section 203(b)( 5 )(M) to the INA. The brand-new section normally permits good-faith capitalists to preserve their qualification after termination of their regional center or debarment of their NCE or JCE. After we alert financiers of the discontinuation or debarment, they might keep qualification either by informing us that check my site they remain to meet eligibility demands notwithstanding the discontinuation or debarment, or by changing their petition to reveal that they meet the requirements under section 203(b)( 5 )(M)(ii) of the INA (which has various demands relying on whether the financier is seeking to preserve eligibility due to the fact that their regional facility was terminated or since their NCE or JCE was debarred).

In all cases, we will make such determinations regular with USCIS plan regarding deference to previous resolutions to ensure regular adjudication. After we terminate a local facility's designation, we will certainly withdraw any kind of Form I-956F, Application for Authorization of a Financial Investment in a Business, connected with the ended regional facility if the Form I-956F was approved since the date on the local center's discontinuation notification.

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

Report this page